FaZe Clan is a dominant force in the world of esports, known for its elite teams in games like Call of Duty, Fortnite, and Counter-Strike: Global Offensive. Beyond competitive gaming, FaZe has also ventured into content creation, lifestyle branding, and collaborations with major celebrities, making it one of the most influential organizations in esports and entertainment. With its massive fan base and cultural significance, FaZe became the first major esports organization to go public, making its stock (FAZE) available on the stock market.

This move was seen as a bold step for the company, but its stock journey has been anything but smooth. In this article, we’ll explore the factors affecting FaZe stock, its rise, challenges, and what investors should keep in mind.

1. The IPO: A High-Profile Launch on the Stock Market

FaZe Clan made headlines when it announced its plans to go public via a merger with a special purpose acquisition company (SPAC). In July 2022, FaZe Holdings officially debuted on the NASDAQ under the ticker symbol FAZE. Initially, the public offering was met with excitement, as FaZe was among the first esports companies to take this major step, setting a precedent for how gaming organizations could monetize their massive online presence.

However, despite the initial buzz, FaZe’s stock faced significant volatility. Investors were eager to see whether the company’s blend of esports and lifestyle branding would translate into long-term success on Wall Street.

2. The Rapid Stock Surge: Why Is FaZe Stock Up 127%?

Recently, FaZe stock saw a dramatic increase, surging by 127% in a single trading day. While FaZe stock had struggled in the months following its IPO, this sudden spike caught the attention of both investors and analysts. The increase can be attributed to a few key factors:

- Short-Squeeze Speculation: Some investors believe that FaZe stock experienced a short squeeze, a situation where traders betting against the stock (short-sellers) are forced to buy back shares to cover their positions, driving up the price.

- Increased Attention from Retail Investors: FaZe’s massive social media following and influence over a young, digitally savvy audience led to increased retail investor interest. Platforms like Reddit, Twitter, and YouTube have amplified the attention around FaZe stock, contributing to its sudden rise.

- Strategic Partnerships and Expansion: FaZe has continued to expand beyond esports, venturing into lifestyle branding, collaborations with high-profile celebrities, and merchandising. This strategic shift has bolstered investor confidence that the company could diversify its revenue streams and capture more market share in the gaming and entertainment space.

3. Challenges and Volatility: What’s Behind FaZe Stock’s Struggles?

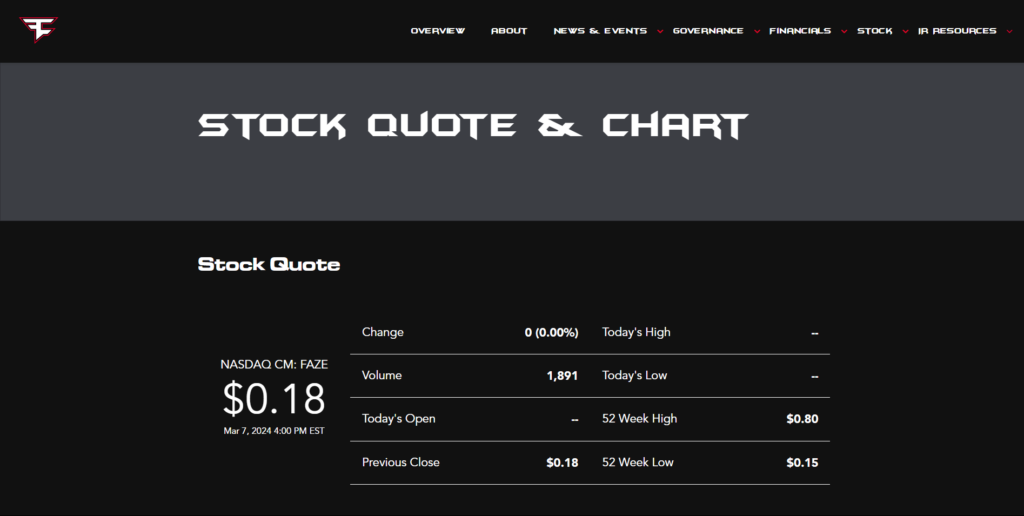

Despite the recent surge, FaZe stock has faced its fair share of challenges since going public. Several factors have contributed to its volatile performance on the market:

1. Financial Struggles

Despite its massive influence, FaZe has struggled to generate consistent revenue. The esports industry is still in its growth phase, and many teams rely heavily on sponsorships and media deals. While FaZe has secured partnerships with brands like McDonald’s and Porsche, it has yet to show long-term profitability that would inspire confidence among institutional investors.

2. High Competition in the Gaming Industry

FaZe competes in a saturated market where other organizations are also vying for attention and sponsorships. With gaming and content creation becoming more competitive, FaZe must find innovative ways to differentiate itself from other esports teams and entertainment platforms.

3. Macroeconomic Factors

The broader economic environment has also played a role. With rising inflation and tightening financial conditions, many investors have pulled back from speculative stocks, impacting FaZe and other companies that rely on long-term growth projections.

4. What’s Next for FaZe Stock? Future Outlook and Considerations

While FaZe has faced volatility in its stock price, the company continues to explore new ventures that could turn things around. Its focus on expanding beyond esports into entertainment, fashion, and content creation could give it more financial stability in the future.

Potential Growth Areas:

- Esports Expansion: FaZe continues to build its esports division by competing in top-tier tournaments across multiple games. As esports grows in popularity, FaZe could capitalize on increased sponsorship opportunities and media rights.

- Media and Content Creation: FaZe’s roster includes not only professional gamers but also content creators who have millions of followers across social media platforms like YouTube and Twitch. By expanding its media presence, FaZe could unlock new revenue streams through advertising, collaborations, and brand deals.

- Collaborations and Partnerships: FaZe has established partnerships with global brands such as Nike and Marvel, blurring the line between gaming and mainstream entertainment. These partnerships could lead to further brand-building opportunities, increasing its appeal to younger consumers.

Is FaZe Stock a Risky Investment or a Growth Opportunity?

FaZe stock remains a fascinating but volatile investment. For investors, it represents a chance to get in on the ground floor of a growing esports empire, but it also carries significant risk due to the company’s financial struggles and stock market volatility. As FaZe continues to diversify its business model and strengthen its position in gaming and entertainment, it may have the potential for long-term growth.

However, as with any stock, it’s essential to weigh the risks against the rewards and consider whether FaZe’s vision of being a cultural powerhouse aligns with its financial realities.